ROS Tax Savings Tip: Take Advantage of Section 179 Deduction

What is Section 179?

Introduction To Section 179 For 2023

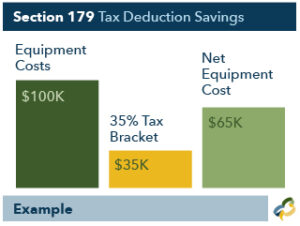

The Section 179 Deduction can be a valuable tax break for businesses that purchase new or used equipment. It can help businesses save money on their taxes and improve their cash flow. Section 179 of the Internal Revenue Code allows businesses to deduct the full cost of certain qualifying equipment in the year it is purchased and placed in service. This is in contrast to the normal depreciation rules, which require businesses to deduct the cost of equipment over a period of years. The Section 179 deduction is available to businesses that purchase or lease new or used qualified equipment for use in their trade or business. The equipment must be used more than 50% of the time for business purposes.

To take the deduction for tax year 2023, the equipment must be financed or purchased and put into service between January 1, 2023 and the end of the day on December 31, 2023.

2023 Deduction Limit = $1,160,000

This deduction is good on new and used equipment, as well as off-the-shelf software. The Section 179 deduction limit for 2023 is $1,160,000. This means that businesses can deduct the full cost of up to $1,160,000 of qualifying equipment purchases in 2023. If a business purchases more than $1,160,000 of qualifying equipment in 2023, the deduction will be reduced dollar-for-dollar for the amount that exceeds $1,160,000.

2023 Total Equipment Purchase Limit = $2,890,000

The total equipment purchase limit is $2,890,000. This means that businesses can deduct the full cost of up to $2,890,000 of qualifying equipment purchases in 2023, even if they exceed the Section 179 deduction limit. However, the excess amount will not be eligible for bonus depreciation. For example, if a business spends $2,000,000 on qualifying equipment in 2023, it can deduct $1,160,000 of that amount using Section 179. The remaining $840,000 would be depreciated over the asset’s useful life.

The Section 179 spending cap is a significant change from previous years. In 2022, the spending cap was $2,700,000. This means that businesses have an additional $190,000 in spending flexibility in 2023.

2023 Bonus Depreciation = 80%

Businesses can also take advantage of bonus depreciation in addition to the Section 179 deduction. Bonus depreciation is a tax break that allows businesses to deduct a larger percentage of the cost of qualifying equipment in the year it is purchased. In 2023, the bonus depreciation rate is 80%. Bonus Depreciation is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used equipment. Businesses can take both the Section 179 deduction and bonus depreciation, but the Section 179 deduction must be applied first. Any amount that exceeds the Section 179 deduction limit can be taken as bonus depreciation.

For example, if a business purchases a $100,000 piece of equipment in 2023, it can deduct $80,000 of the cost in the year of purchase using bonus depreciation. The remaining $20,000 can be depreciated over the asset’s useful life.

The Section 179 deduction and bonus depreciation can be a valuable way for businesses to save money on taxes. Businesses should consult with a tax advisor to determine if they are eligible for these deductions and to calculate the amount of their deduction.

Eligible Equipment

Section 179 is an IRS tax code that allows businesses to deduct the full cost of qualifying equipment and/or software purchased or leased from your “gross income” during the tax year. Basically, this is an incentive from the U.S. Government to encourage businesses to buy or lease equipment and invest back in their company.

- Machinery and equipment

- Computers and software

- Vehicles

- Office furniture and fixtures

- Heavy machinery

- Breeding livestock

- Single-purpose structures

Section 179 is one of the few incentives that actually helps small businesses and millions of small businesses are taking action and getting real benefits by investing back into their business with equipment acquisitions that both benefit their business and their bottom line.

The amount you save in taxes may in fact exceed the payments which makes this very attractive to the bottom line.

Section 179 Questions

Are Vehicles Covered Under Section 179?

There are limitations to which vehicles are covered. Section 179 does have a 50% rule. The financed or purchased vehicle must be used at least 50% of the time or more by the company to qualify for the 179 Tax Deduction.

How Do I Claim The Section 179 Deduction?

To claim the Section 179 deduction, you must file Form 4562 with your federal income tax return. You must also make the election to claim the deduction on Form 4562.

How Much Can I Save on My Taxes This Year?

It depends on how much qualifying equipment and software you purchase and put into use this year.

To calculate the Section 179 deduction, you will need to determine the amount of the equipment purchase, the percentage of business use, and the applicable deduction limit.

When Do I Have to Do This By?

Section 179 always expires at midnight, December 31st. So to take advantage of Section 179 this year, you must buy (or lease/finance) your equipment, and put it into use, by December 31st of this year.

When Do I Have To Elect The Section 179 Deduction?

You must elect the Section 179 deduction on your federal tax return for the year in which you place the equipment in service.

Can I Use The Section 179 Deduction If I Lease Equipment?

Yes, you can use the Section 179 deduction if you lease equipment. However, the deduction is limited to the amount of the lease payments that are made in the year the equipment is placed in service.

Can I Use The Section 179 Deduction If I Purchase Equipment With A Loan?

Yes, you can use the Section 179 deduction if you purchase equipment with a loan. The deduction is limited to the amount of the loan that is paid in the year the equipment is placed in service.